-40%

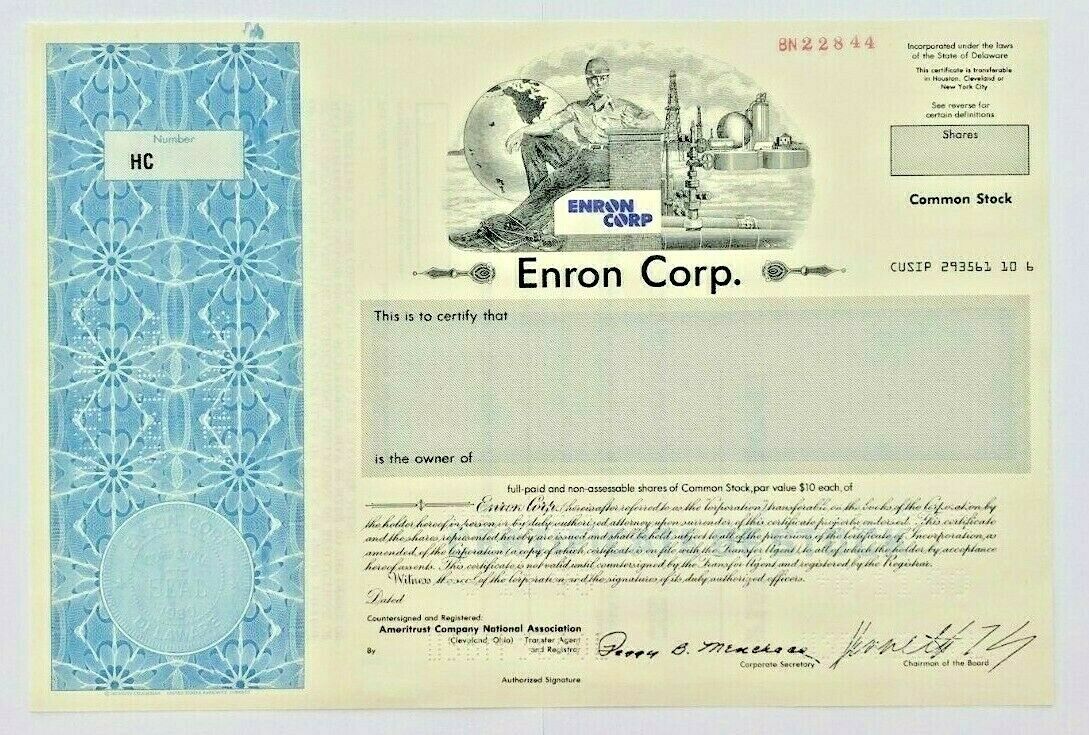

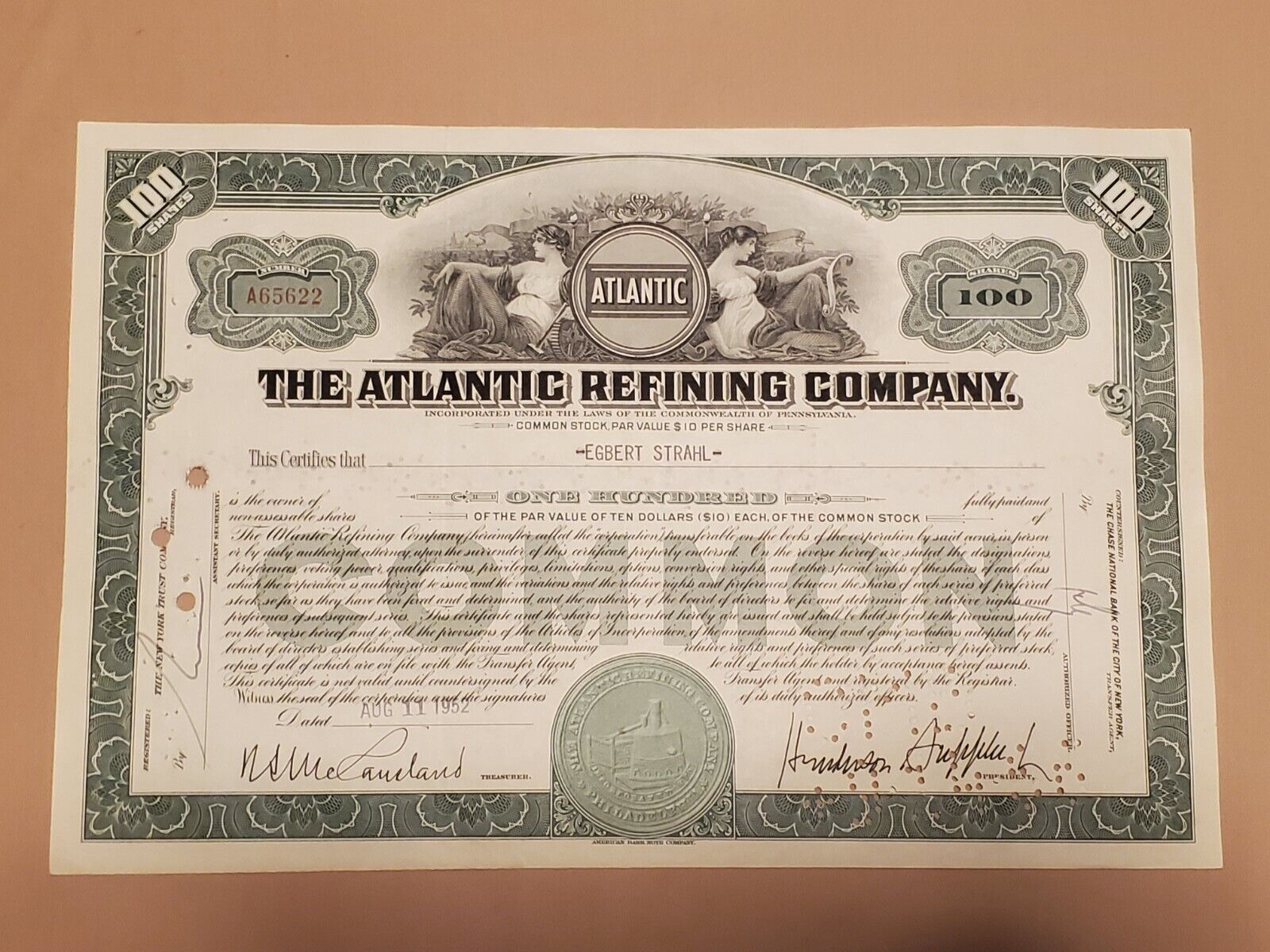

Enron Corporation SPECIMEN Stock Certificate - HUGE SCANDAL - FRAUD - VERY RARE!

$ 791.99

- Description

- Size Guide

Description

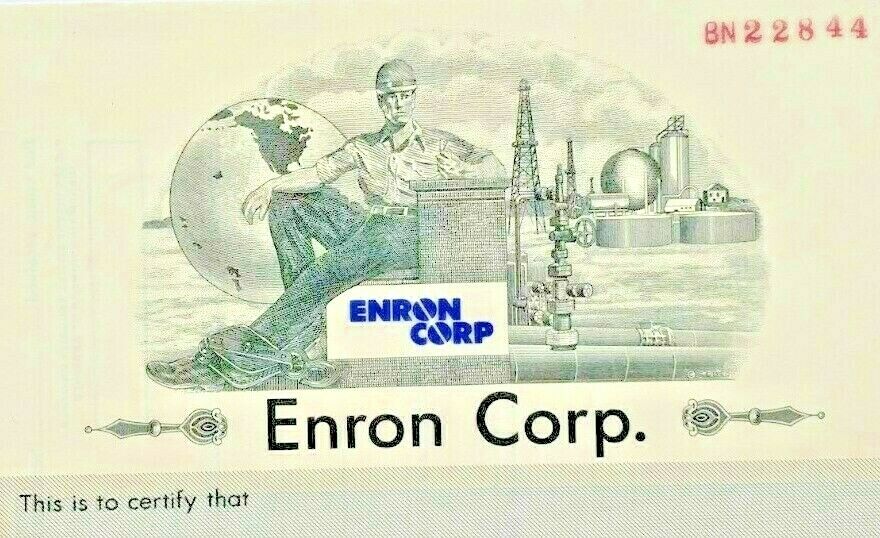

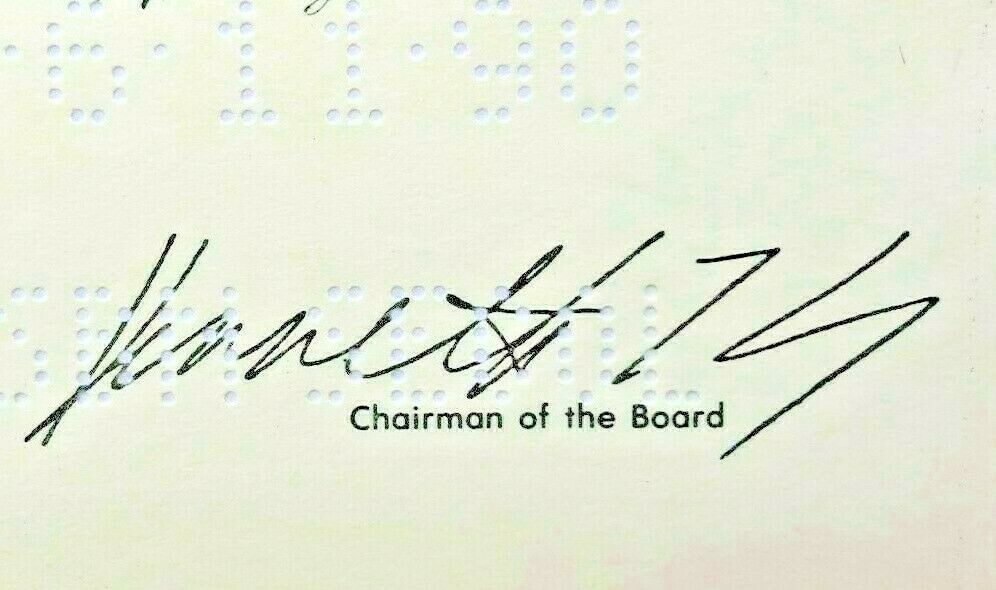

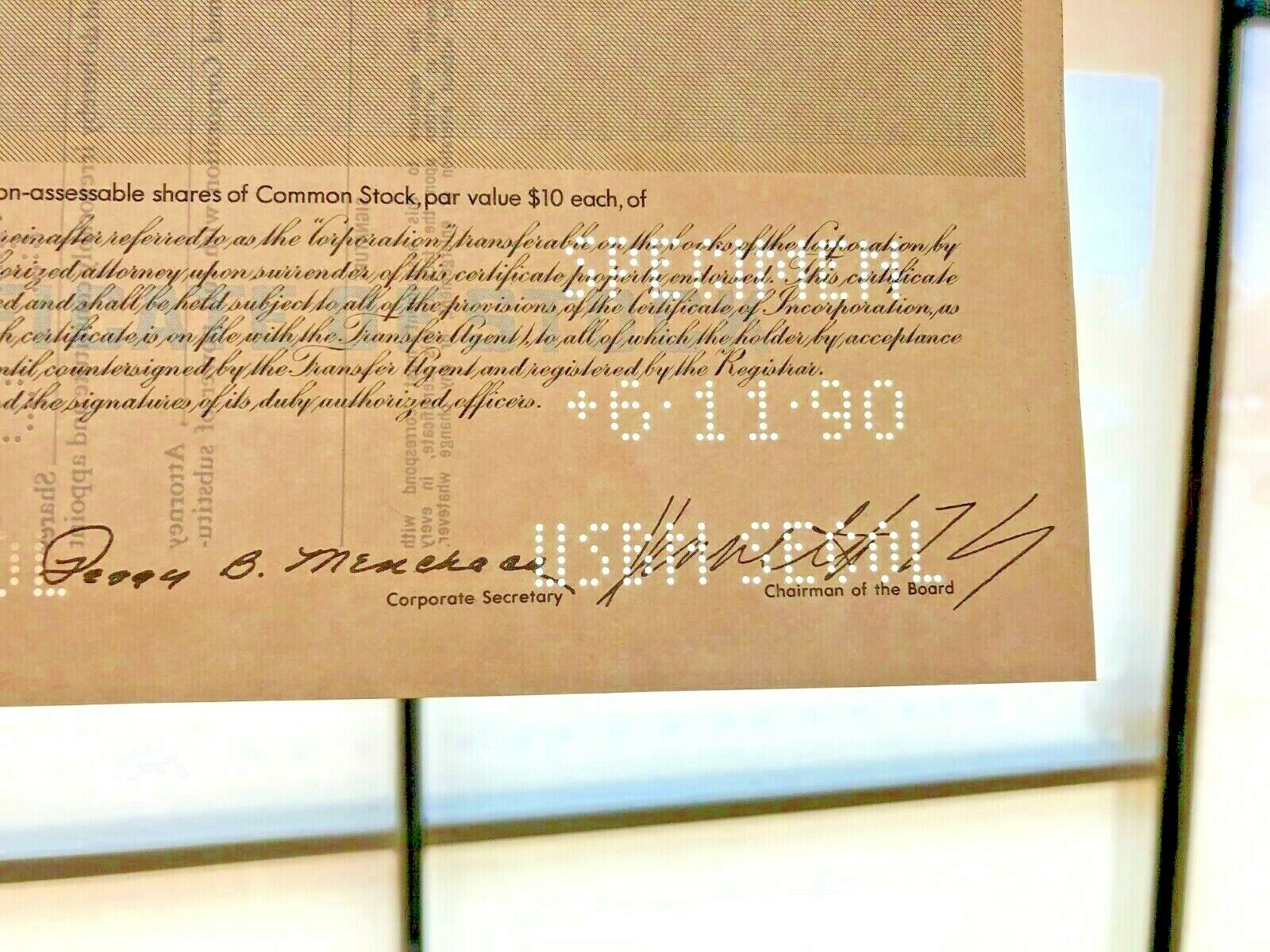

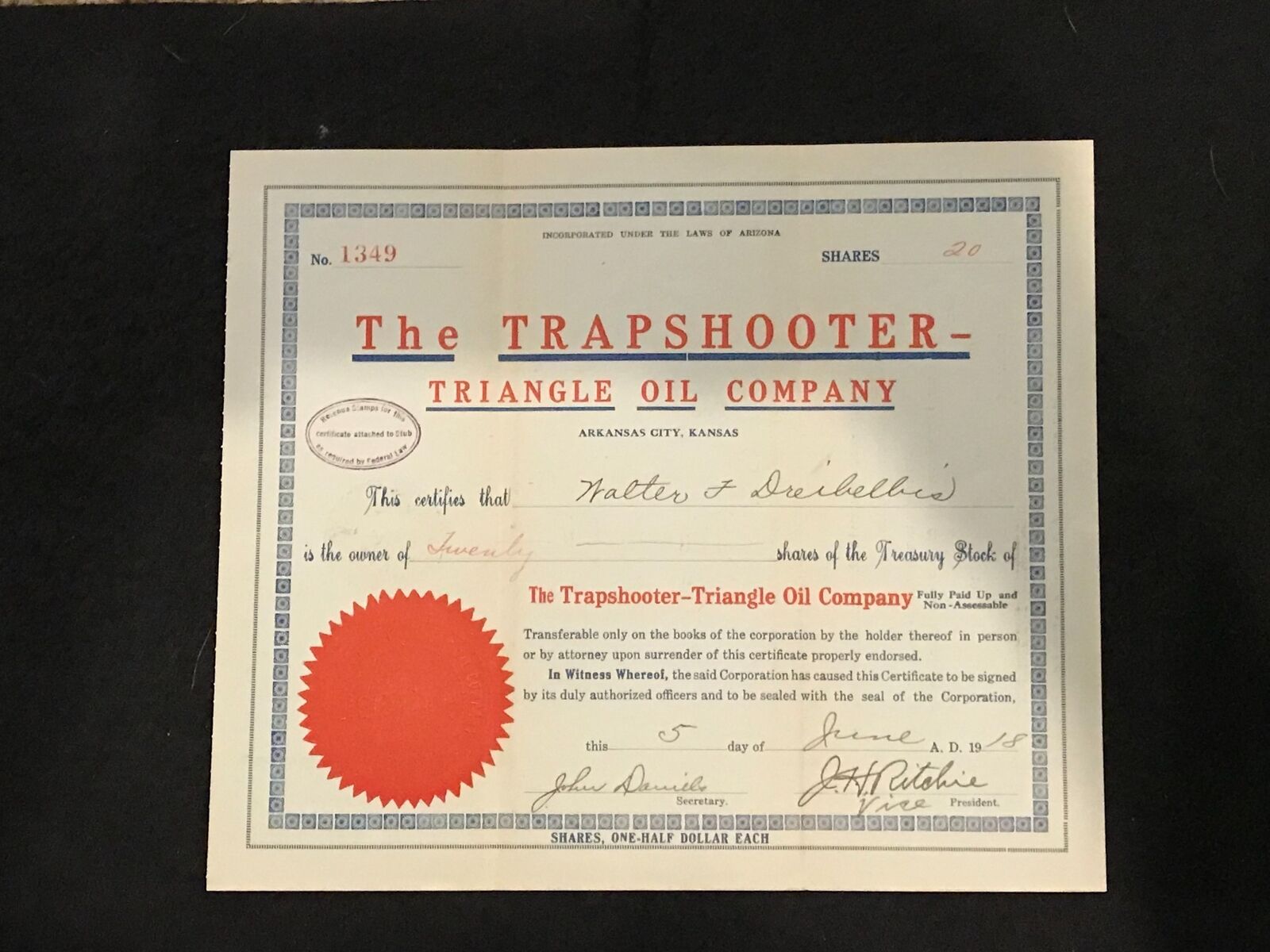

This is an Enron SPECIMEN Stock Certificate - One of only a couple ever made! Ken Lay Facsimile Signature!!!!You will never see one of these again!!!!

The Certificate is pristine - a perfect 10.

The two photos of the pinhole punch show certificate as dark beige - it is not that is just the back lighting of the sun making the certificate appear dark. I wanted to show the pin punch SPECIMEN and date.

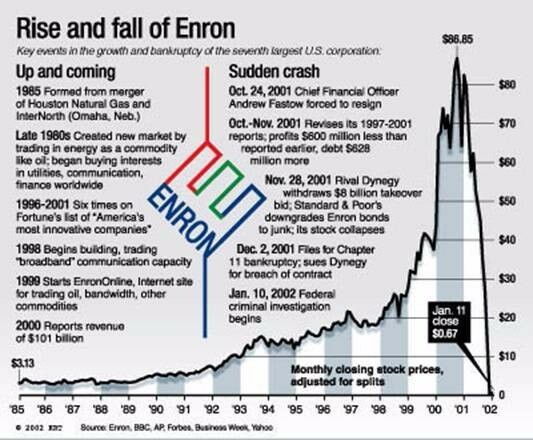

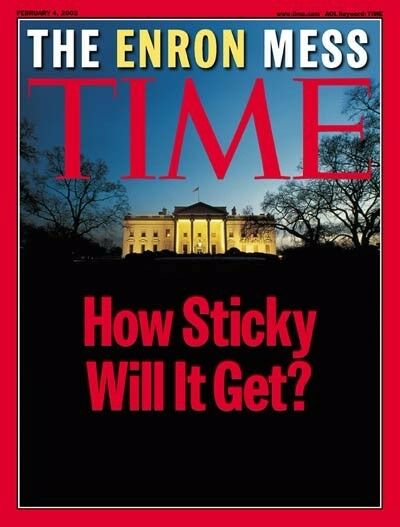

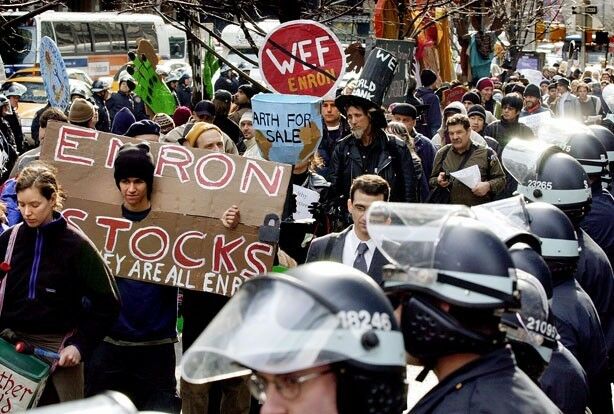

This historic stock certificate was the focus of one of the biggest scandals in American stock market history. Enron is now the symbol of greed and mismanagement.

Enron was an energy company based in Houston TX. In 2000 it claimed nearly a billion dollars in revenue but filed for bankruptcy in New York in late 2001! Enron was a world leader in electricity, natural gas, and pulp and paper. It was plagued with systemic accounting fraud which quickly became known as the “Enron Scandal”.

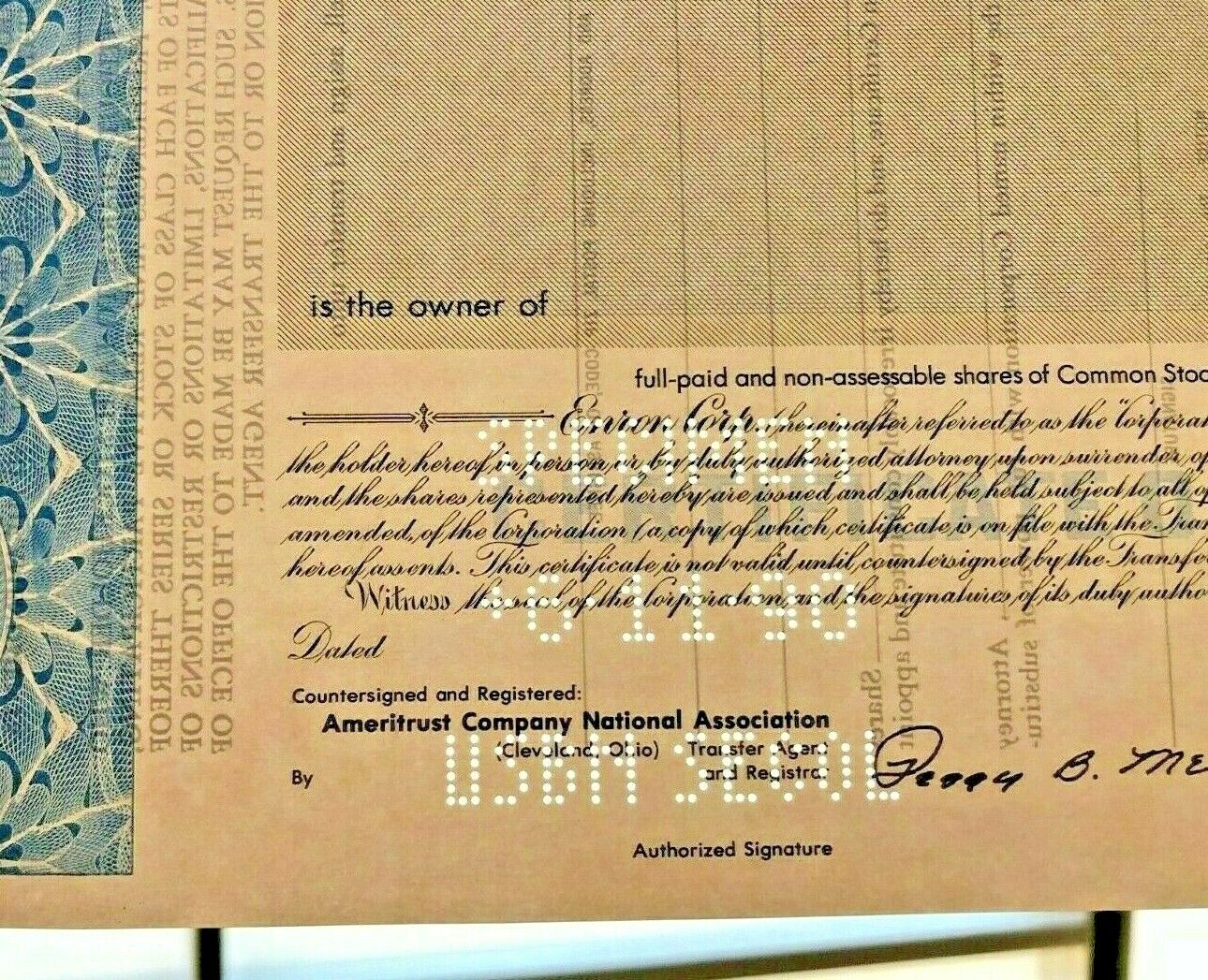

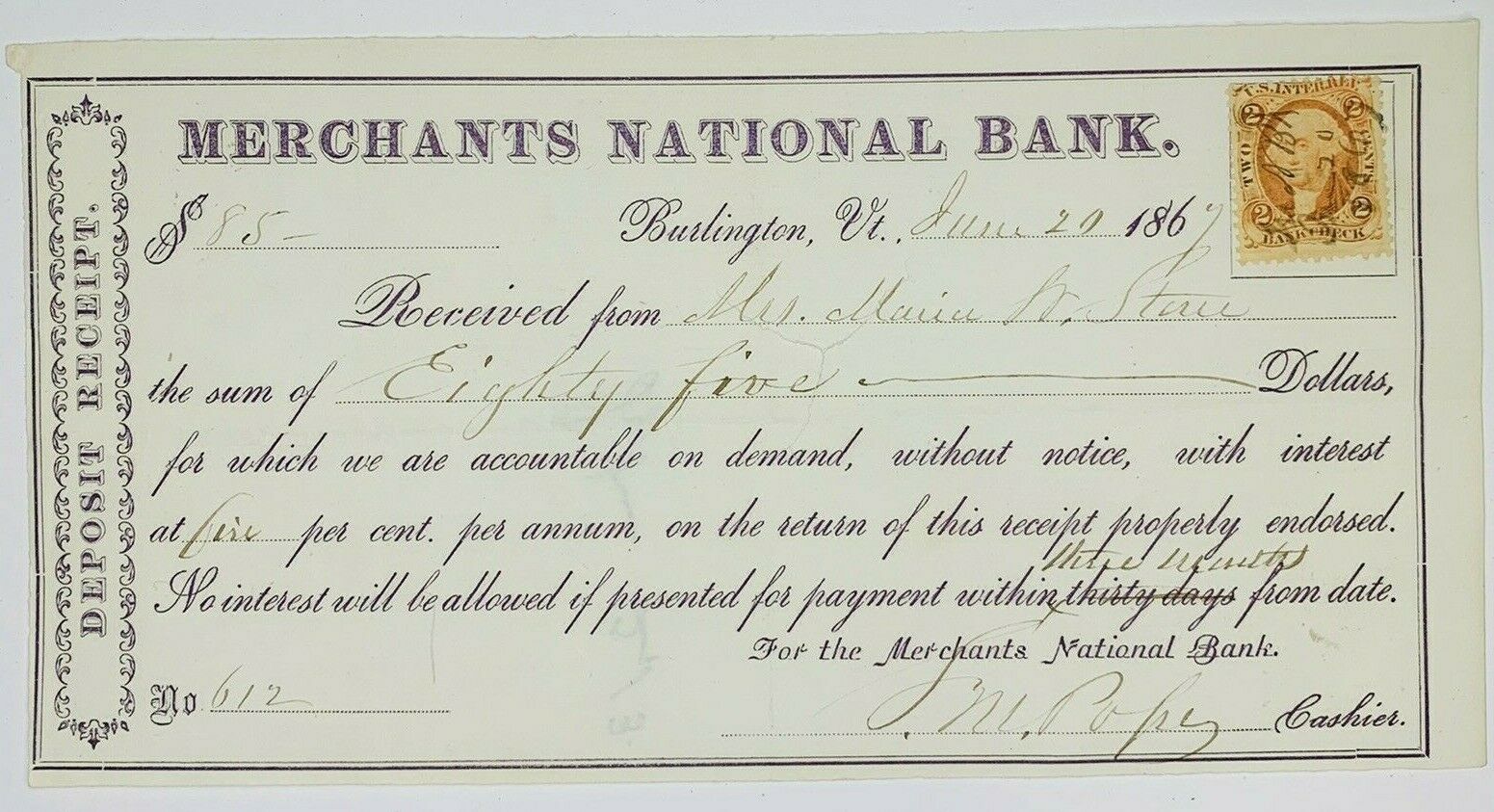

Specimen Certificates

are actual certificates that have never been issued. They were usually kept by the printers in their permanent archives as their only example of a particular certificate.

Often there were only a few Specimen certificates ever made making them extemely rare!!!!!!! There were several hundred thousand issued and cancelled shares but only a few of these pristine specimens.

Sometimes you will see a hand stamp on the certificate that says "Do not remove from file".

Specimens were also used to show prospective clients different types of certificate designs that were available. Specimen certificates are always much scarcer than issued certificates. In fact, many times they are the only way to get a certificate for a particular company because the issued certificates were redeemed and destroyed. In a few instances, Specimen certificates were made for a company but were never used because a different design was chosen by the company.

These certificates are normally stamped "Specimen" or they have small holes spelling the word specimen. Most of the time they don't have a serial number, or they have a serial number of 00000.

Considering the intense notoriety this company received it is amazing that this came from either the printer or Enron's corporate file and made it down to street level without someone snatching it for their personal collection.

You have

one

chance - then it's gone!!!!

The Enron scandal, publicized in October 2001, eventually led to the bankruptcy of the Enron Corporation, an American energy company based in Houston, Texas, and the de facto dissolution of Arthur Andersen, which was one of the five largest audit and accountancy partnerships in the world. In addition to being the largest bankruptcy reorganization in American history at that time, Enron was cited as the biggest audit failure.

Enron was formed in 1985 by

Kenneth Lay

after merging Houston Natural Gas and InterNorth. Several years later, when Jeffrey Skilling was hired, he developed a staff of executives that – by the use of accounting loopholes, special purpose entities, and poor financial reporting – were able to hide billions of dollars in debt from failed deals and projects. Chief Financial Officer Andrew Fastow and other executives not only misled Enron's board of directors and audit committee on high-risk accounting practices, but also pressured Andersen to ignore the issues.

Enron shareholders filed a billion lawsuit after the company's stock price, which achieved a high of .75 per share in mid-2000, plummeted to less than by the end of November 2001. The U.S. Securities and Exchange Commission (SEC) began an investigation, and rival Houston competitor Dynegy offered to purchase the company at a very low price. The deal failed, and on December 2, 2001, Enron filed for bankruptcy under Chapter 11 of the United States Bankruptcy Code. Enron's .4 billion in assets made it, up to that point, the largest corporate bankruptcy in U.S. history.

Many executives at Enron were indicted for a variety of charges and some were later sentenced to prison. Enron's auditor, Arthur Andersen, was found guilty in a United States District Court of illegally destroying documents relevant to the SEC investigation which voided its license to audit public companies, effectively closing the business. By the time the ruling was overturned at the U.S. Supreme Court, the company had lost the majority of its customers and had ceased operating. Enron employees and shareholders received limited returns in lawsuits, despite losing billions in pensions and stock prices. As a consequence of the scandal, new regulations and legislation were enacted to expand the accuracy of financial reporting for public companies. One piece of legislation, the Sarbanes-Oxley Act, increased penalties for destroying, altering, or fabricating records in federal investigations or for attempting to defraud shareholders. The act also increased the accountability of auditing firms to remain unbiased and independent of their clients.

This will be carefully packed and shipped via Fed Ex directly to your door with tracking information.

Please ask any questions before bidding!!!

Bid with confidence - I have a 100% rating!!!

NO International Bidders please......